estate tax changes in reconciliation bill

Increases to the. Gift in 2021 of 11000000.

No Expected Estate Tax Exemption Increase Under The Build Back Better Legislation

Any modified AGI of an estate or trust in excess of 200000 would now be subject to a tax equal to 5.

. Corporate rate increase to 265 as proposed in the Ways and Means bill is also not supported by Sen. The amended change would raise the cap to 80000 from 2021-2030 and revert back to 10000 for 2031. In addition any modified AGI of an estate or trust in excess of 500000 would now be subject to a.

Gift in 2021 of 0. The current 117M1 estate and gift tax exclusion was provided under a temporary law. Under current law a 38 tax is imposed on Net Investment Income NII on certain individuals estates or trusts if a trade or business is a passive activity for the taxpayer ie the taxpayer does not materially.

This proposal if enacted will take effect January 1 2022. Estate planning changes dropped from US budget reconciliation Bill. 5376 the Bill proposes sweeping changes to tax rules that apply to individuals and trusts with far-reaching implications for estate planning.

Some of the changes most likely to impact clients include. As congressional Democrats continue their. A 5 surtax on individual income in excess of 10 million per year with an additional 3 on income in excess of 25 million.

Manchin has previously supported some of Bidens proposals to hike taxes including an increase to the corporate tax rate. This is estimated to bring in 230 billion over 10 years. The latest draft of the US Congress budget reconciliation Bill omits most of the previously proposed tax changes that would have affected US estate planning.

Increases to the income tax rates. Instead it contains three primary changes affecting estate and gift taxes. At the same time the bill would raise taxes substantially for those making 1 million or more according to a new analysis by the Tax Policy Center.

Biden initially proposed 28. This provision would generally be effective for. Thursday 04 November 2021.

Effective January 1 2022. Estate and gift tax exemption. Individual rate increases.

Estate is 10000000 Exemption 0. An individual rate increase to 396 and top capital gains rate increase to 25 as proposed in the Ways and Means bill are doubtful since Sen. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

This preliminary analysis is still available here. Effective January 1 2022 the lifetime federal estate and gift tax exclusions will be reduced from the current 117 million exemption to the 2010 level which would be approximately 6 million. Death in 2022.

Cut in half the basic exclusion amount reducing the estate gift and GST tax exemptions from 11700000 to approximately. The bill provides that taxpayers with AGI of 400000 or more and all trusts and estates would only be allowed to exclude 50 of the eligible gain. And even though the legislation is still subject to change there are proposed provisions that.

In 2010 the estate tax was eliminated. Under EGTRRA the 55 to 45. Reconciliation Bill To Target Trusts Estates And The Wealthy.

A Medicare tax crackdown. The giftestate tax exemption currently is 10 million adjusted for inflation 117 million in 2021. Most of the major proposals that would create substantial changes in the estate planning arena were not included.

Net Investment Income Tax Expanded 138203. Uncertainty makes tax and estate planning more challenging. Estate Tax 15000000 X 40 6000000.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The Legislation includes significant tax proposals that if passed will dramatically change the tax and estate planning landscape for high-income and high-net worth individuals. Five Tax Implications of the Budget Reconciliation Bill for Retirement Savers.

Reduce the current 11700000 per person gift and estate tax exemption the unified exemption by approximately one half. Estate is 16000000 Exemption 1000000. On November 1 2021 the House Rules Committee reported out the Build Back Better Act Reconciliation Bill which leaves out most.

Major tax changes in draft reconciliation bill. Sinema opposes all such increases. The bill is over 800 pages long and contains a myriad of other tax law changes.

It is scheduled to revert to 5 million plus inflation in 2026. Revised Build Back Better Bill Excludes Major Estate Tax Proposals In late October the House Rules Committee released a revised version of the proposed Build Back Better Act Reconciliation Bill. Instead per Axios Manchin will settle for a domestic minimum rate of 15 a proposal that Sinema previously backed.

It is estimated that the unified exemption adjusted for inflation would be approximately 6030000 in 2022. This means the current inflation-adjusted exemption of 11700000 per person would be reduced to approximately 6000000. On September 26 2021 the House Budget Committee released House Report No.

Estate is 21000000 Exemption 5300000. It would apply a 5 rate above income of 10 million with an additional 3 surtax on income above 25 million. The House budget reconciliation bill HR.

The many changes floated since the presidential and congressional elections of 2020 would have reduced the. All major provisions of the House Ways Means Committees budget reconciliation tax bill would cut 2022 taxes on average for households making 200000 or less. He told Axios that hed still like to see the corporate rate rise to 25.

Estate Tax 10000000 X 40 4000000. If enacted the Bill would among other things. 107-16 among other tax cuts provided for a gradual reduction and elimination of the estate tax.

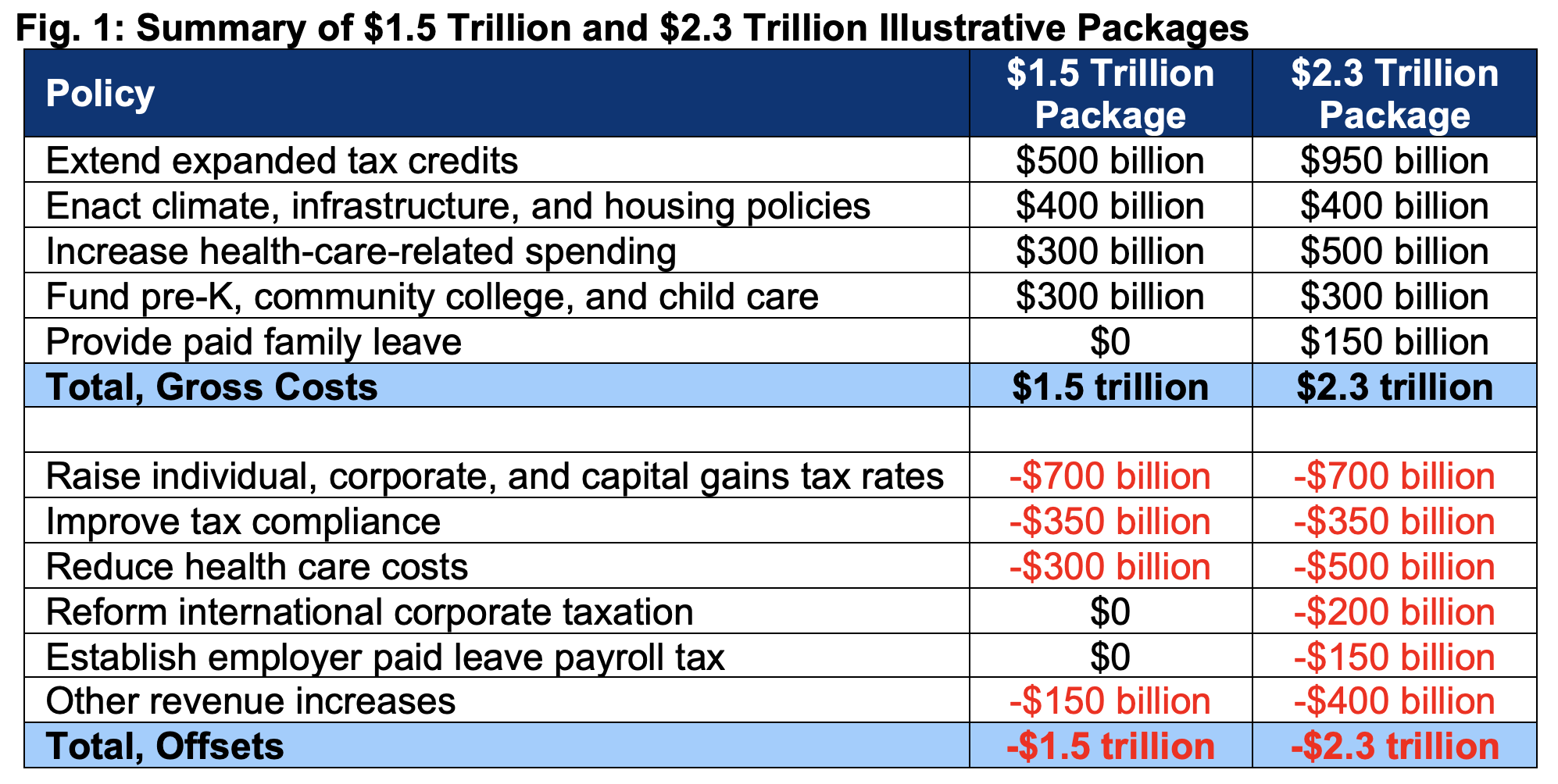

Estate Tax 15700000 x 40 6280000. Take note of these revenue offsets and their potential effective dates. There was general agreement that some sort of estate tax would be retained.

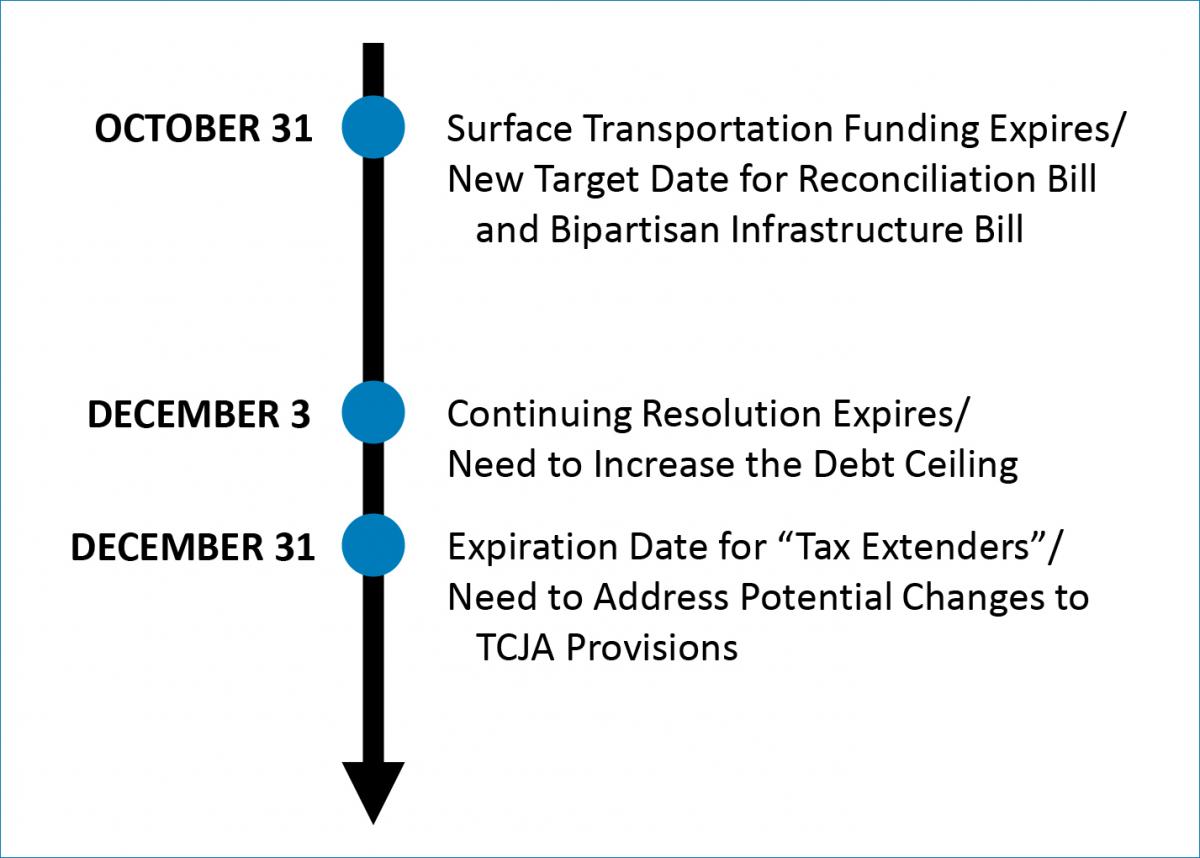

This analysis was updated to contain the November 4th amended changes to the cap on the state and local tax SALT deduction. The Infrastructure Bill passed the House and President Biden signed it into law on November 15th yet Congress continues to debate the repayment details of the Budget Reconciliation Bills provisions. Surcharge on High Income Estates and Trusts 138203.

The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. Even without any act of Congress the exclusion will be cut in half effective January 1 2026. Potential Tax Impact on Estate Planning.

13 released the draft text of their proposed tax-raising provisions which was the subject of a committee markup. The Build Back Better Framework released by the White House made no mention of increases to the capital gains rate basic individual or corporate income tax rates or significant amendments to the estate and gift tax regime. Growth and Tax Relief Reconciliation Act of 2001 EGTRRA.

As negotiations over spending and taxes in a potential budget reconciliation bill tentatively the Build Back Better Act are ongoing in Congress Democrats on the House Ways and Means Committee on Sept. Many of the key tax benefits currently associated with the utilization of grantor trusts will no longer be available if the House proposal is passed in its current form.

The Democrats Have A Lot Of Cutting To Do The New York Times

Estate Tax Examples Of Estate Tax Estate Tax Rate

Tpc The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else

Democrats Eye Tax Opportunities In 2021 Grant Thornton

The New Death Tax In The Biden Tax Proposal Major Tax Change

What S Actually In Biden S Build Back Better Bill And How Would It Affect You Us News The Guardian

Proposed Tax Law Changes Which May Impact You Certilman Balin

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

Tpc The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else

Senators Propose Sweeping Changes To The Taxation Of Estates And Inherited Gains

Will It Or Wont It Newest Reconciliation Bill Lacks Major Estate Tax Law Changes

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Proposed Tax Changes For High Income Individuals Ey Us

Tax Take Time Keeps On Slippin Slippin Slippin Into The Future Miller Chevalier

Estate Tax Law Changes What To Do Now

The Democrats Have A Lot Of Cutting To Do The New York Times

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget